HX Trends: Electronics

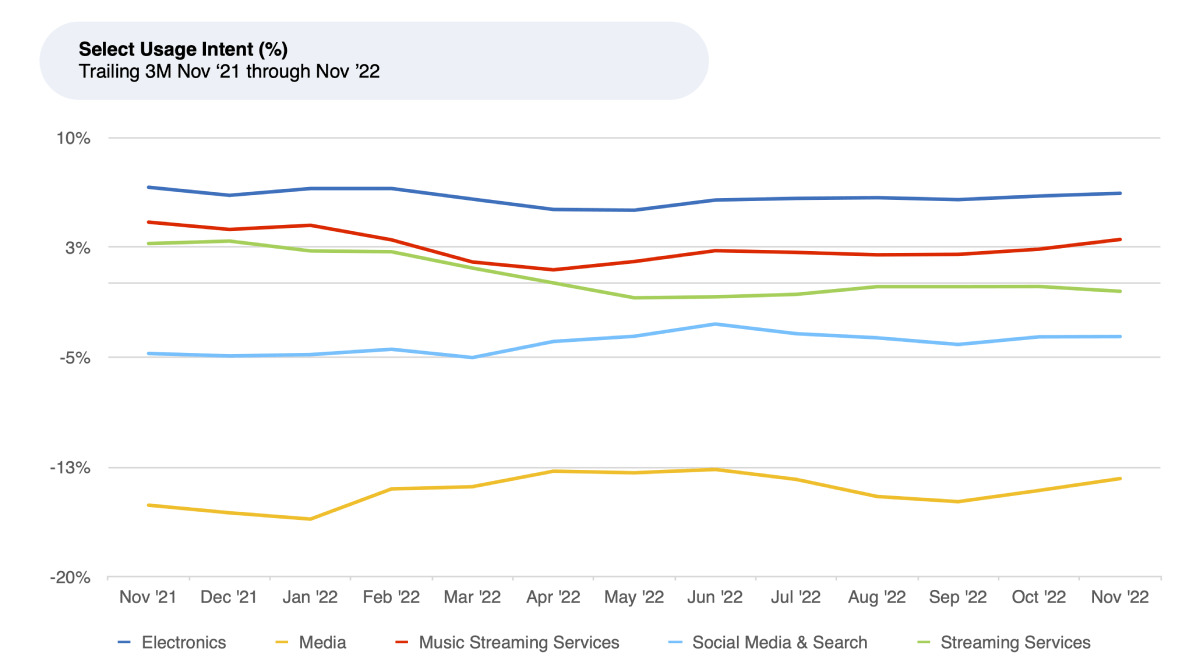

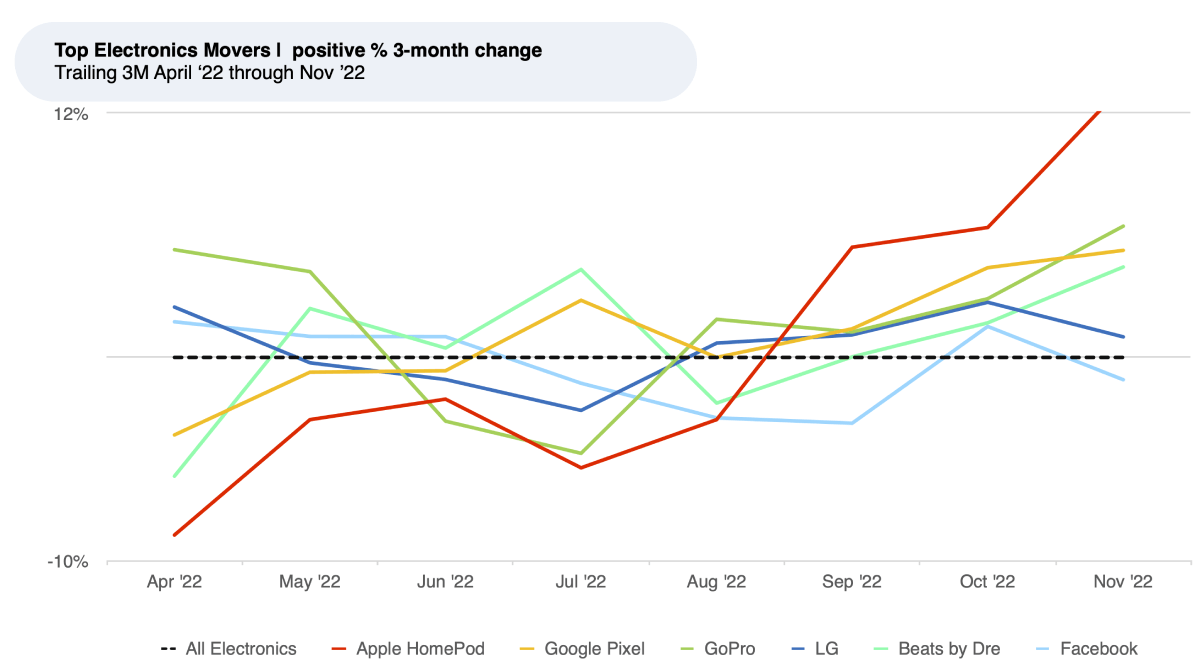

- Electronics’ usage intent remained positive and stable during the past six months, with select speakers / audio (Apple HomePod, Beats by Dre) and video (GoPro, Facebook Portal) brands among the ones gaining far more than others.

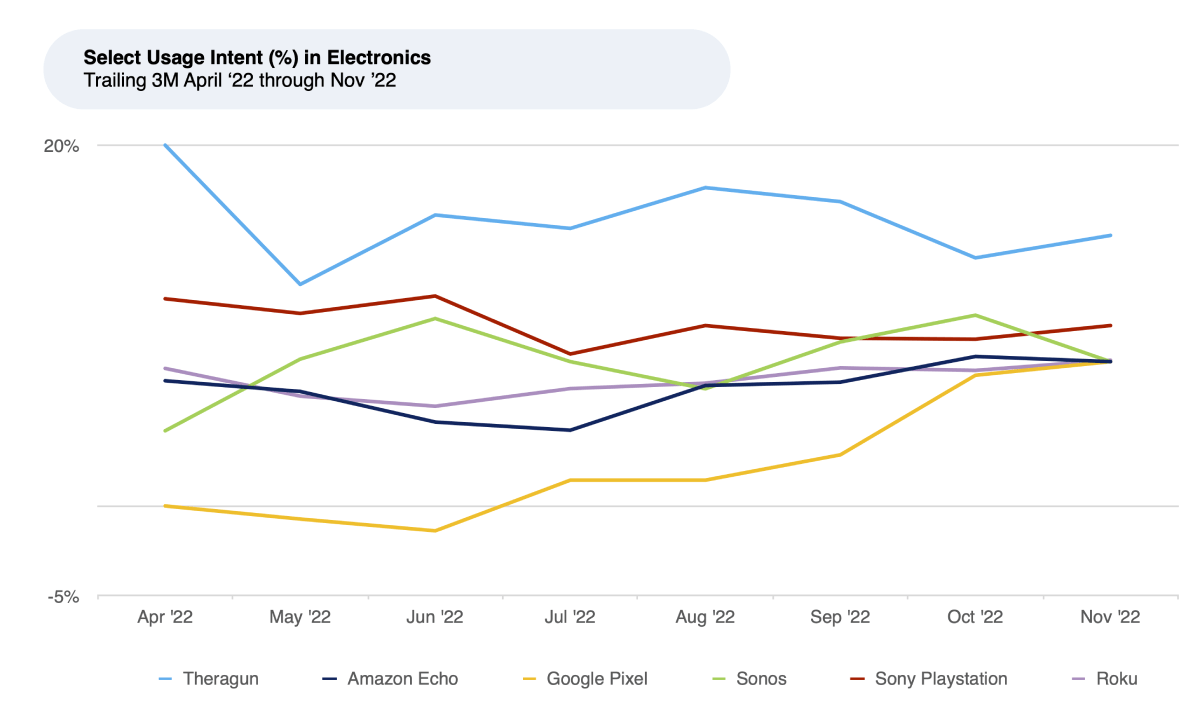

- Theragun remains the top product overall, but Apple continues to dominate all other brands broadly, with its HomePod experiencing the strongest usage intent of its portfolio.

- The top Electronics brands do a great job of satisfying customers on the factors they say are most important: Technology, Usability, and Price.

- The strong usage growth trends indicate Apple HomePod, GoPro, and Beats By Dre all are likely to experience market share growth. Usage is correlated with share of time spent and retention, which can be a leading indicator of market share.

Top Overall Usage Intent leaders

Apple Mac usage intent rose from 8% in April 2022 to 12% in October before easing to 10% in November. While most computer brands (Lenovo, Dell, HP, Asus) saw shipments fall steeply in Q3 2022, Apple Mac sales are up 40% year-over-year according to IDC. Promotions on the M1 24” Mac and the discontinuation of the 27” Mac helped boost volume. Quality satisfaction (69% vs. 54% broader Electronics) remains the Mac’s strong preference point, followed by Design (68% vs. 55%), and Usability (63% vs. 59%).

Top Usage Intent Movers

Apple HomePod, Lenovo, and GoPro had the largest three-month usage intent improvements for our electronics coverage. Below we look at the products and brands that posted the largest three-month increase November versus August 2022.

Apple HomePod has seen the greatest intent gain over the last three months, rising from -8% in August to +13% in November 2022. The competitive home smart speaker category remains hot, and Apple’s clear dominance in other areas carries over. HomePod saw the greatest improvements in customer sentiment towards its Technology, Design, and Quality.

Customer Satisfaction most impacted by Technology, Usability, and Price

We also find Customer Satisfaction (CSAT) for Electronics (4.5) has remained steady over the course of the last year, one of the top measures for any sector in our coverage. HundredX measures CSAT on a 5-point scale.

HundredX measures sentiment toward a CSAT driver as Net Positive Percent (NPP), which is the percentage of customers who say a driver (such as Quality or Price) is a reason they like a brand/product minus the percentage who say it is a reason they do not like it. The top factors driving Electronics’ customer satisfaction, and the reasons why they prefer specific brands, include Technology (chosen as the top driver, 72% of the time), Usability (71%), Price (70%), Install/Setup (68%), and Design (66%).

While The Crowd tells us that the overall outlook for usage intent will most likely continue its mixed trend, share for specific brands will continue to shift with the popularity of various products. We continue to monitor trends within Electronics a

nd Consumer Products to see if any changes emerge as the shopping season progresses, as well as into 2023.

- All metrics presented, including Net Usage Intent (Usage Intent), and Net Positive Percent / Sentiment are presented on a trailing three-month basis, unless otherwise noted.

Strategy Made Smarter

HundredX

works with a variety of companies and their investors to answer some of the most important strategy questions in business:

- Where are customers "migrating"?

- What are they saying they will use more of in the next 12 months?

- What are the key drivers of their purchase decisions and financial outcomes?

Current clients see immediate benefits across multiple areas including strategy, finance, operations, pricing, investing, and marketing.

Our insights enable business leaders to define and identify specific drivers and decisions enabling them to grow their market share.

Please contact our team to learn more about which businesses across 75 industries are best positioned with customers and the decisions you can make to grow your brand’s market share.

HundredX is a

mission-based data and insights provider

. HundredX does not make investment recommendations. However, we believe in the wisdom of the crowd to inform the outlook for businesses and industries. For more info on our data solutions, other companies within 75+ other industries we cover, or if you'd like to learn more about using Data for Good, please reach out:

https://hundredx.com/contact

.

Share This Article